Purchasing real estate for the sake of renting can be a solid investment strategy. With reliable tenants and a good rental rate, you can cover the cost of the mortgage, insurance, utilities, and taxes, with some left over for profits. In DFW, a thriving economy attracts numerous workers and families, creating a high demand for rental properties.

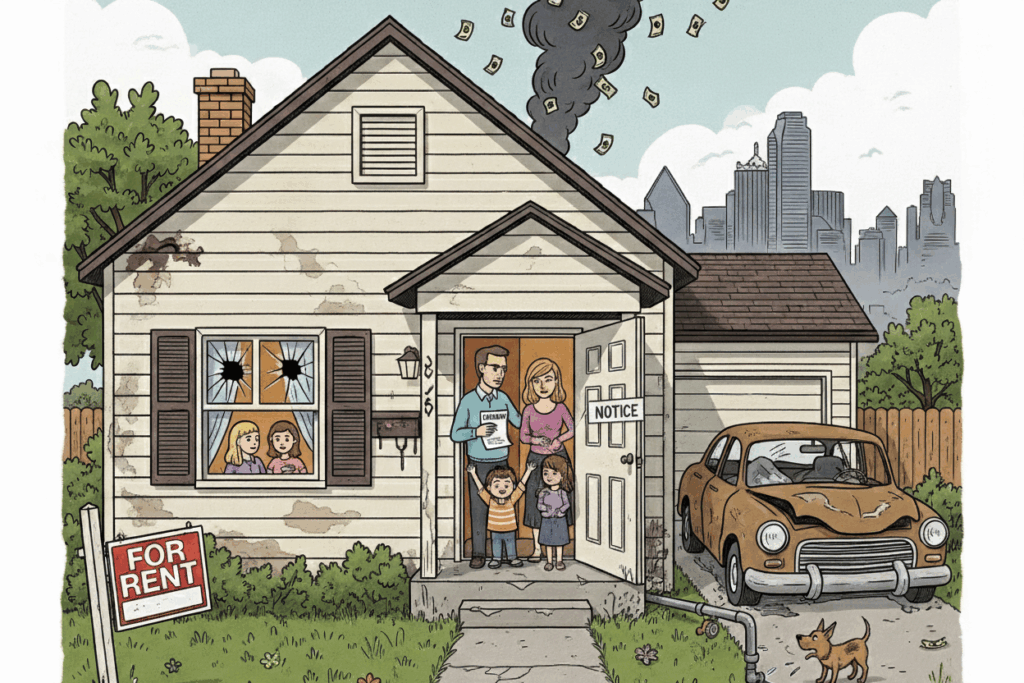

Unfortunately, there is a downside to owning a rental property in DFW. If the house is in disrepair or the tenants mistreat the house, it could become a difficult asset to maintain. Problematic tenants are extremely stressful for investment property owners, so selling may be the only option to recoup some money and avoid the hassle.

In this guide, we will discuss some solutions to sell your property in Fort Worth or Dallas.

Table of Contents

- Challenges of Selling Tenanted Rental Properties in DFW

- Attempting to Sell a Rental Property with Tenants Through Traditional Methods

- The Eviction Process in Texas

- The Best Way to Sell a Rental Property with Bad Tenants

- Key Benefits of a Cash Sale for Your DFW Rental Property

- Financial Aspects to Consider When You Sell a Rental Property in DFW

- FAQs

- Move on From Your Problem Rental Property in Dallas-Fort Worth

Challenges of Selling Tenanted Rental Properties in DFW

Rental property owners already face challenges when selling houses with tenants in them. First, you will need to address occupancy, which may involve either evicting a tenant or transferring management of the property to the new owner. Buyers may be less interested in tenanted properties because tenants do not always take good care of their homes.

The challenges are even greater when you have a bad tenant in your investment property. Whether they are uncooperative, causing damage to the house, falling behind on rent, or refusing to allow access for showings, this can make a traditional sale feel impossible.

If you plan to sell your rental property due to a bad tenant, these complicating factors will make it more challenging to find a willing buyer, even in a desirable market like DFW.

How Difficult Tenants Can Disrupt Traditional Real Estate Transactions

Difficult tenants can essentially sabotage a traditional real estate sale. They can refuse to vacate the property for scheduled showings, making it impossible to show off the property to potential buyers.

A tenant could leave a bad impression on a potential buyer based on their behavior or how they treat the property. Tenants may also cause delays that would jeopardize open-market sales.

The Financial Impact of Bad Tenants on Rental Income and Property Condition

Even if you manage to find a buyer who will overlook the behavior of the sitting tenant, you could suffer for it financially. Damage to the home will significantly reduce its market value, hurting your ability to profit from the sale.

If the tenant is falling behind on rental payments, your income will be directly affected, potentially forcing you to sell your property quickly. If the failed payments continue, you may not have enough money to repair the property before a sale, which could result in a loss of resale value.

As you can see, a bad tenant can be a significant burden to a rental property owner. Their actions can directly impact your ability to sell the house using a real estate agent and traditional methods.

Attempting to Sell a Rental Property with Tenants Through Traditional Methods

A traditional sale typically involves hiring a real estate agent, making repairs to the property, staging it for showings, marketing the house, and negotiating with buyers once offers are received.

While this strategy could work to achieve the highest purchase price in DFW, troublesome tenants may make this route impossible.

The Problem with Traditional Marketing Strategies for Occupied Rental Properties

Advertising an occupied investment property is difficult, even for an experienced real estate agent. Standard practices, such as professional photographs, open houses, and private showings, may not be feasible because another person or family is living in the home.

If you are lucky, your tenants will be accommodating enough to help clean the property and allow access for showings. Unfortunately, a difficult tenant will make these conventional marketing approaches more challenging, as they may be uncooperative or fail to maintain the property in good condition.

Navigating Texas Tenant Rights and Showings

Several Texas laws protect the rights of tenants when occupied properties are being sold. First, they have the right to quiet enjoyment of their home, which means they are not legally obligated to vacate the property for showings.

Additionally, you cannot force them to clean or stage the rental property for a potential buyer. Tenants must receive a 24-hour notice if a showing is scheduled.

As a result, you must hope for an accommodating tenant or buyers who do not care about seeing the unit in person. In either case, the tenant’s legal rights could ultimately delay the sale.

The Eviction Process in Texas

One solution you could pursue for a troublesome tenant is eviction. This is a drastic step that involves evicting a tenant from a rental property for violating their lease contract, allowing you to sell a vacant property.

However, the eviction process can be extremely lengthy, especially since you must issue an eviction notice of at least three days if the lease agreement does not include a specific timeline.

If the tenant does not vacate the premises in a timely manner, you can file an eviction suit; however, this will only prolong the process. Eviction is a costly legal process in Tarrant County, so this solution may not be worth the trouble. Plus, the condition of the property may make it hard to sell even if they leave.

The Best Way to Sell a Rental Property with Bad Tenants

The most effective solution for recouping your investment and moving on from difficult tenants is a direct sale to a cash home buyer. Cash offers are an efficient, painless, and stress-free alternative to traditional open-market sales, cutting out many of the upfront costs and delays that typically accompany these transactions.

If you are a landlord in DFW with an uncooperative tenant, a cash home buyer can provide relief.

How a Cash Sale Eliminates Tenant-Related Selling Problems

A cash sale can eliminate many tenant-related problems during the home-selling process. First, a cash buyer is often a seasoned real estate investor accustomed to purchasing rental properties with tenants already in place. Second, the buyer can take over the tenant side of things once the sale is completed, ensuring you get a clean break from the investment property.

You can avoid direct interactions and unnecessary negotiations with your tenant about the sale when you work with a cash buyer like A-List Properties.

We Buy Your Rental Home As-Is, Regardless of Tenant Condition

The primary benefit of selling to our team is that you don’t have to do any work to prepare the rental property. We buy homes as is, which means no amount of repairs or tenant difficulties will prevent the deal from closing.

No matter how damaged or unclean the property is due to your tenants, we will make a fair cash offer so you can avoid the hassle.

Key Benefits of a Cash Sale for Your DFW Rental Property

A cash sale can help you meet your financial goals on a timeline that works. If you want to exit your investment property cleanly, this is the fastest and simplest solution. Some of the advantages of selling to A-List Properties include a guaranteed sale, certainty, no real estate agent commissions, and no hidden fees.

A Fast and Guaranteed Closing for Your Rental Home

Speed can be the biggest stress reliever when you need to sell your rental property. Since the eviction process and traditional sale timeline can drag on for months, you will be holding onto that burden for a considerable amount of time.

Since we can close deals in 14 days or less, you can quickly liquidate the asset and end your property manager responsibilities for the rental property.

Certainty in an Uncertain Situation: Bypassing Market Conditions

Dealing with difficult tenants can lead to considerable uncertainty. What if they do significant damage to the property before the sale, diminishing its resale value? Will they agree to clean up the home so that buyers will like what they see during showings and open houses? Can they make up their late rental payments to maintain your income stream?

All this uncertainty can make an open-market sale extremely frustrating. With a cash home buyer, you have a guaranteed sale that is not dependent on picky buyers, troublesome tenants, lender approvals, or fluctuating market conditions.

No Agent Commissions or Hidden Fees on Your Rental Property Sale

Another element when selling rental properties is the upfront costs. When you sell a home, whether it is a primary residence or an investment property, you must pay for real estate agent fees, closing costs, repair expenses, and other fees before receiving a cent from the successful sale.

By selling your home to A-List Properties, there is no real estate agent involvement. As a result, real estate agent commissions and closing fees will not reduce the net proceeds you receive from the sale. This ensures you have the necessary funding to purchase the next rental house for your real estate portfolio.

Financial Aspects to Consider When You Sell a Rental Property in DFW

Selling an investment property is a significant financial transaction, so there are always fiscal implications to consider. Landlords must consider capital gains taxes, market trends, and potential rental income losses.

Let’s take a closer look at how these elements affect the process of selling rental properties.

Your Potential Capital Gains Tax Liability

When you sell an investment asset for more than you paid to acquire it, you may have to pay capital gains tax rates to the federal government. The capital gains tax depends on the increased value of the asset, how long you have owned it, and what you do with the proceeds from the sale.

This is an important consideration when selling real estate; therefore, consult a tax professional or a real estate attorney for expert advice.

How Current Market Trends Can Influence Your Decision

The real estate market in DFW can change on a dime. A house that is worth $400,000 in August in a seller’s market could realistically be worth $360,000 by the end of September if the rental market starts to decline.

Being at the mercy of the real estate market can make an investment opportunity risky. If you sell to a cash buyer now, you eliminate these fluctuations from the equation due to the speed of the transaction.

Halting the Loss of Rental Income with a Quick, Certain Sale

If a tenant is not keeping up with their rent payments, it can quickly start to hurt. Each month, you may only generate a couple of hundred dollars of profit after paying off the mortgage, utilities, taxes, and insurance.

Lost rental income can cause significant financial bleeding for a rental house owner. Or, the property may have lost value because of damage done by the tenant. Either way, a speedy sale with Texas home buyers may be the only way to stop the bleeding as quickly as possible without paying thousands in upfront costs.

FAQs

Do I Have to Evict My Tenants Before I Can Sell a Rental Property in DFW?

You do not have to evict tenants before transferring ownership of your investment property to A-List Properties. In fact, it is illegal to kick out tenants unless you have cause or they have violated the lease agreement, even for an impending sale.

However, our team will still purchase the rental property and assume management of it. This way, your tenants will have a smooth transition to new ownership (even if they may not deserve that courtesy because of their behavior).

Will You Still Buy My Rental Home if the Tenants Have Caused Significant Damage?

We buy homes in all conditions. Whether the property has outdated HVAC systems, a decaying roof, or damaged appliances due to tenant behavior, A-List Properties is not afraid to inherit a troubled investment.

Our goal is to help out fellow Texans facing difficult situations, even if that includes a rental property with uncooperative tenants.

How Does the Sale Process Work if My Tenants Are Still on a Lease in Texas?

Tenants have the right to remain in their homes after a sale as long as their leases are still in effect and they have not violated any terms. As the owner, it is a good practice to provide the tenant with a notice of an impending sale so they are informed.

Other than that, the sale can proceed in the standard way. With A-List Properties, it takes just three easy steps to sell your rental property:

- Contact us and tell us about your house’s condition and location

- Schedule a walkthrough so we can assess the property value and tenant situation

- Accept a fair cash offer and choose a closing date that works for you

How Do Fluctuating Market Conditions Affect My Cash Offer for Rental Properties?

The beauty of a cash offer is that there are no financing delays or buyer negotiations involved. As a result, once you accept the offer, A-List Properties can close the deal in as little as seven days. This takes all the guesswork out of the sale and removes the element of market fluctuations from the equation.

With a traditional sale, which can take months in DFW, the market would have more time to shift and affect the property value of your rental before closing.

Are There Tax Implications Beyond Capital Gains Tax That I Should Be Aware of When I Sell a Rental Property?

There are several tax obligations to consider before you sell a property in Dallas and Fort Worth. First, the IRS allows landlords to use tax deductions for natural depreciation. However, they typically charge depreciation recapture taxes for a small percentage when you sell the property.

Another potential tax issue is related to property taxes. Depending on when you sell investment property, you may have to pay for prorated property taxes, especially with traditional sellers. You must also consider how rental payments affect your taxable income.

A-List Properties will factor these expenses into the cash offer.

Move on From Your Problem Rental Property in Dallas-Fort Worth

Moving on from your rental property is far more difficult when tenants do not cooperate. They can damage the resale value of your home or refuse to vacate for showings. Selling a rental property to A-List Properties is a fast and effective solution for tenant-occupied assets.

You can resolve your situation efficiently with a no-obligation offer from our team. Contact us today at 972-526-7042 or complete the online form to request your free cash offer.

Zach Shelley

Zach Shelley is a seasoned real estate investor with a diverse network spanning across the nation. As the founder of his own real estate venture, Zach is committed to offering innovative solutions to homeowners facing various real estate challenges.. Through his dedication and strategic approach, Zach continues to make a significant impact in the real estate industry, providing homeowners with alternative pathways to navigate their property transactions.