When property taxes go unpaid, the outcome depends on whether you live in one of the tax deed vs tax lien states. Either way, the consequences of delinquent property taxes are serious. Local governments rely on these payments to fund essential services, and when taxes go unpaid, they have powerful legal tools to recover the debt.

For Texas homeowners, falling behind on taxes can be especially stressful, with the real risk of foreclosure. A-List Properties offers practical solutions for those facing tax debt, helping homeowners protect their future and move forward with confidence.

Table of Contents

- What Is a Tax Deed Sale?

- What Is a Tax Lien Sale?

- How Do Tax Deed Sales Work?

- Understanding Tax Deed States vs Tax Lien States

- The Redemption Period Explained

- The Redeemable-Deed Hybrid System in Texas

- Tax Deed Investing: Risks and Rewards

- What Happens to a Tax Deed Property in Texas?

- Options to Pay Property Taxes

- Why Texas Property Owners Turn to Cash Buyers

- FAQs

- A Fast and Simple Solution for Tax-Distressed Properties

What Is a Tax Deed Sale?

A tax deed sale occurs when an owner doesn’t manage to pay real estate taxes, and the taxing authority auctions off the property deed. The highest bidder wins and becomes the new owner, while the former owner loses all rights to the home.

For investors, tax deed auctions present an opportunity to acquire real estate at a minimum bid often tied to the outstanding taxes. For the delinquent owner, however, the tax deed process carries the serious risk of losing their property entirely if they cannot pay the taxes owed.

What Is a Tax Lien Sale?

A tax lien sale occurs when an owner fails to pay taxes and the local government places a legal claim, or lien, against the property for the taxes owed. The property owner still retains ownership, but must pay the taxes, along with accrued interest and penalties, to clear the lien.

Investors who purchase tax lien certificates earn a profit when the owner redeems the property by paying off the outstanding taxes. For a tax lien investor, the appeal lies in collecting interest payments on the tax debt, while the property owner faces added costs until the tax lien is fully resolved.

How Do Tax Deed Sales Work?

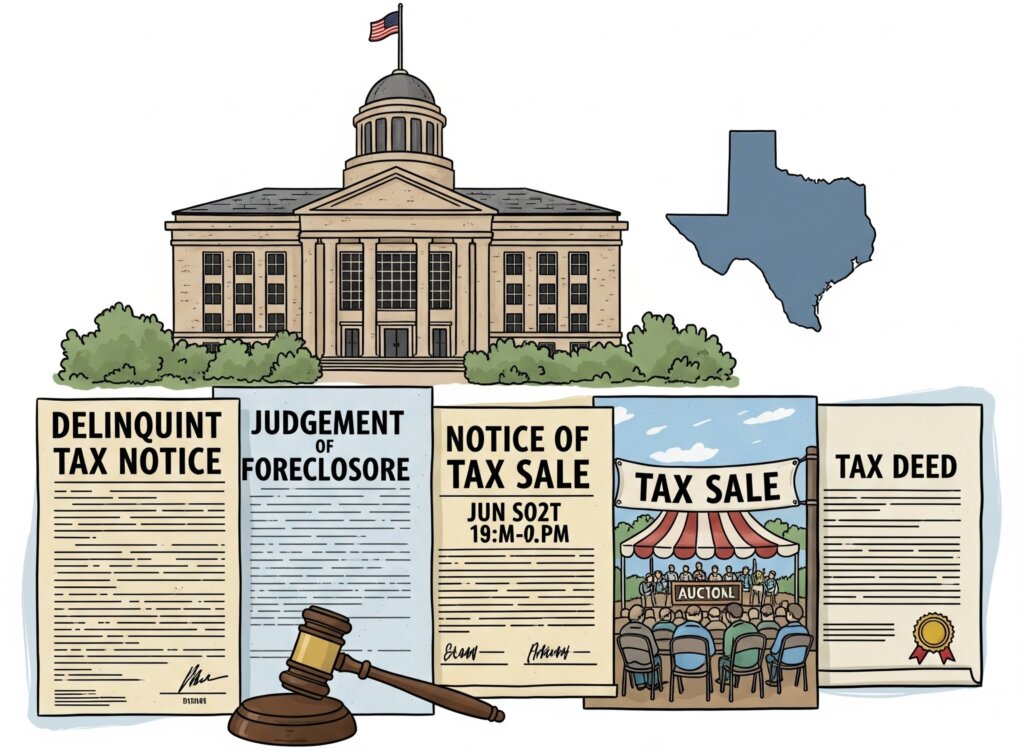

The tax deed process begins when an owner doesn’t manage to pay real estate taxes, and the delinquent taxes remain unpaid beyond the redemption period set by local governments. At that point, the taxing authority initiates a sale to recover the taxes owed. These sales are conducted through public auctions, usually organized by the county.

At the auction, bidding often begins with a minimum bid designed to cover the overdue taxes, accrued interest, and any administrative or legal costs tied to the property. Investors then compete, and the highest bidder wins. Once payment is made, the deed to the property is transferred, granting the new buyer full ownership of the property.

Understanding Tax Deed States vs Tax Lien States

Across the U.S., states handle overdue property taxes through either tax lien sales or tax deed sales.

In tax lien states, investors buy tax lien certificates, and owners must repay taxes, penalties, and interest to keep their property. If unpaid, the lien holder may foreclose. In tax deed states, the process is more direct. The deed is auctioned, and the highest bidder gains ownership once the redemption period ends.

Texas is a unique hybrid. While classified as a tax lien state, its system has deed-like features. Investors purchase a lien at auction, but the redemption period for the owner is short, typically six months to two years, depending on the property. If the owner fails to pay the taxes during that window, the investor takes the deed.

This structure creates opportunities for investors while placing heavy pressure on homeowners who fall behind. For Texas homeowners, even a short delay in tax payments can put their property rights at serious risk.

The Redemption Period Explained

The redemption period is the window of time a property owner has to reclaim their home after delinquent property taxes trigger a tax lien or tax deed sale. Its length and rules vary by state, but it is one of the most essential safeguards for owners.

In tax lien certificate states, the redemption period is the time during which the owner can pay property taxes, along with interest and penalties, to clear the upcoming tax lien. If payment is made, the lien owner collects interest, and the owner retains ownership of the property. If the debt remains unpaid, the tax lien investor may eventually move forward with foreclosure.

In tax deed states, redemption periods are often shorter or may end once the deed is sold at auction. When the period closes without payment of the taxes, the previous owner loses all rights to the property, and the tax deed purchaser gains full ownership.

The Redeemable-Deed Hybrid System in Texas

Texas is unique because it blends elements of both tax lien and tax deed states, creating what’s called a redeemable-deed hybrid system. When a property owner fails to pay taxes, the county sells a tax lien certificate at auction.

At that auction, investors bid for the right to pay the delinquent taxes, and the winning bidder receives a deed to the property. Unlike in traditional tax deed states, however, this deed is not immediately final–it is issued subject to redemption.

The owner has a specific redemption period to reclaim the property by paying the taxes, along with penalties and interest. In Texas, this window is short: usually six months for most properties, and up to two years for homesteads or agricultural land.

If the owner redeems, the investor receives repayment plus interest, essentially profiting like a tax lien holder. If the deadline passes without repayment, the investor’s deed becomes permanent, transferring full ownership.

For distressed homeowners in Texas, these strict redemption rules highlight how quickly unpaid taxes can threaten property rights.

Tax Deed Investing: Risks and Rewards

Tax deed investing appeals to many real estate investors because it offers the chance to acquire properties at prices well below market value.

When the owner doesn’t manage to pay property taxes and the home goes to a tax deed auction, investors who win the bidding receive ownership of the property itself. This type of real estate investing can create opportunities for significant returns, but it also carries unique risks.

A tax deed property may come with title issues, hidden liens, or outstanding municipal charges that the new owner becomes responsible for. In addition, the condition of the property is often unknown at the time of purchase, and repairs or code violations can add unexpected costs.

Experienced tax deed investors account for these risks by conducting research, understanding local and municipal laws, and preparing for additional expenses. For average homeowners or inexperienced buyers, however, these challenges can be overwhelming and financially damaging.

What Happens to a Tax Deed Property in Texas?

Once a tax deed property is sold at auction in Texas, the winning bidder receives a deed that becomes permanent if the delinquent owner fails to redeem within the set period. After that deadline passes, complete ownership transfers to the investor, who can choose to occupy the home, rent it out, or resell it for profit.

For the original owner, this often means facing eviction once their redemption rights expire, even if the property has been in the family for generations. Beyond the financial loss, the emotional toll of losing a home to unpaid property taxes can be devastating, disrupting stability and displacing families.

While tax deed investors may see opportunity in resale potential, the delinquent property owner experiences the heavy consequences of unpaid taxes, losing both property rights and the security of their home.

Options to Pay Property Taxes

Homeowners who fall behind on property taxes still have options to resolve the debt before it results in a tax lien or tax deed sale.

Many counties offer payment plans that let homeowners spread out overdue taxes in monthly installments, helping them catch up gradually. Others may choose to refinance their mortgage or use a home equity loan to pay back taxes.

In some cases, selling the property before it reaches auction is the most practical way to avoid losing ownership entirely.

For Texas homeowners who need a faster solution, A-List Properties offers a simple, cash-based alternative. We buy houses directly, even when delinquent taxes are owed, giving you the ability to stop the process in its tracks. By selling quickly, you can pay off outstanding taxes, avoid foreclosure risks, and move forward without the emotional and financial strain.

Why Texas Property Owners Turn to Cash Buyers

For Texas homeowners facing delinquent property taxes, the stress of looming foreclosure or a potential tax deed sale can feel overwhelming. Selling directly to a Texas cash home buyer like A-List Properties offers a practical way out before the taxing authority steps in.

Unlike traditional sales, working with a cash buyer means there are no delays from lenders, no repairs required, and no lengthy waiting period. Instead, you get a fast closing and immediate relief from the debt tied to unpaid property taxes.

Our company specializes in helping distressed homeowners across Texas. With deep knowledge of state laws and the unique redeemable-deed system, we understand how quickly unpaid taxes can threaten property rights.

Our local expertise allows us to guide homeowners through the sale process with ease, providing a straightforward solution that removes financial pressure. For many, selling to A-List Properties is the stress-free way to regain control and move forward.

FAQs

Can a property owner reclaim their house after a tax deed sale?

In most tax deed states, once the redemption period has expired and the property deed is transferred, the former owner cannot reclaim the home. Some states allow a short redemption period after the sale, but if taxes remain unpaid, ownership passes permanently to the tax deed purchaser.

Is Texas a tax deed state or a tax lien state?

Texas is officially a tax lien certificate state, but operates under a redeemable-deed hybrid system. Investors purchase tax lien certificates at auction, and the property owner has a limited redemption period. If the owner doesn’t pay taxes plus penalties within that timeframe, the tax lien purchaser gains full ownership of the property.

How quickly should I act if I can’t pay property taxes?

Property owners should act immediately if they fall behind on taxes. Delays can add penalties, interest, and legal costs, making repayment harder. In Texas, redemption periods are short, and waiting too long may result in losing the property entirely. Exploring payment plans or selling before the auction can protect your equity.

A Fast and Simple Solution for Tax-Distressed Properties

Tax-distressed properties can put homeowners in danger of losing all their equity. If you must beat a property tax deadline, you can sell to A-List Properties for a fair cash offer. Our quick and hassle-free process allows homeowners to offload their properties quickly and prevent foreclosure or a tax deed sale.

Call us today at 972-526-7042 or complete the online form to request a fair cash offer.

Zach Shelley

Zach Shelley is a seasoned real estate investor with a diverse network spanning across the nation. As the founder of his own real estate venture, Zach is committed to offering innovative solutions to homeowners facing various real estate challenges.. Through his dedication and strategic approach, Zach continues to make a significant impact in the real estate industry, providing homeowners with alternative pathways to navigate their property transactions.