Most homeowners sell their properties the usual way, using a real estate agent and the traditional sale process. This is often the best option when you want to make as much money as possible from the sale. However, there are some circumstances in which a different strategy might be beneficial to both the seller and the buyer.

A quitclaim deed is a way to transfer property that is quicker than a traditional sale and requires much less paperwork. Although it makes sense in the right circumstances, it’s important to understand how a quitclaim deed works and what risks it carries.

What Is a Quitclaim Deed?

A quitclaim deed is a faster way of transferring property from one party to another. Quitclaim deeds are often used when a house is transferred between family members, during a divorce proceeding, and when a couple gets married. In a legal sense, the quitclaim deed transfers the current property owner’s interest in the home to another person.

There are a few hiccups that can occur with a quitclaim deed. First, though it is a legal document, it does not guarantee that the property’s original owner has full ownership rights to the home. There may be a lienholder or another person’s name on the deed that is not disclosed.

All the quitclaim deed does is ensure the original owner will have no future ownership interest in the property. Since the quitclaim deed affects ownership, it is wise to ask for a title search to find out if the seller has full ownership rights of the property. Otherwise, if the buyer intends to sell the home in the future, they could run into an ownership battle with previous lienholders.

How to Transfer Property With a Quitclaim Deed?

Quitclaim deeds make the transfer of property ownership much faster. This is why they are a popular option for non-sale situations, such as gifting a property to a family member or adding a new spouse to the property deed of a home. The process itself is far simpler than a traditional sale and can take just a few weeks to complete, if not less. There are four simple steps required to complete a quitclaim deed transfer:

- Find the quitclaim deed form within your county and fill it out, either online or on a physical document.

- Complete the requested information, including both parties’ names, a property description, and other details.

- Get the quitclaim deed notarized and signed by both parties so that it is legally viable.

- File the quitclaim deed with the county clerk’s office to complete the property transfer.

Can You Sell a House With a Quit Claim Deed?

Selling a house with a quitclaim deed is possible, although this process is typically used to transfer property between family members in non-sale situations. However, if you can find a buyer to trust you, it could be a much faster way to sell your Texas home than the traditional method.

Additionally, selling your house with a quitclaim deed usually involves more risk to the buyer, so you shouldn’t expect to make as much money as you would from a normal sale. You may need to lower the listing price to attract these kinds of buyers.

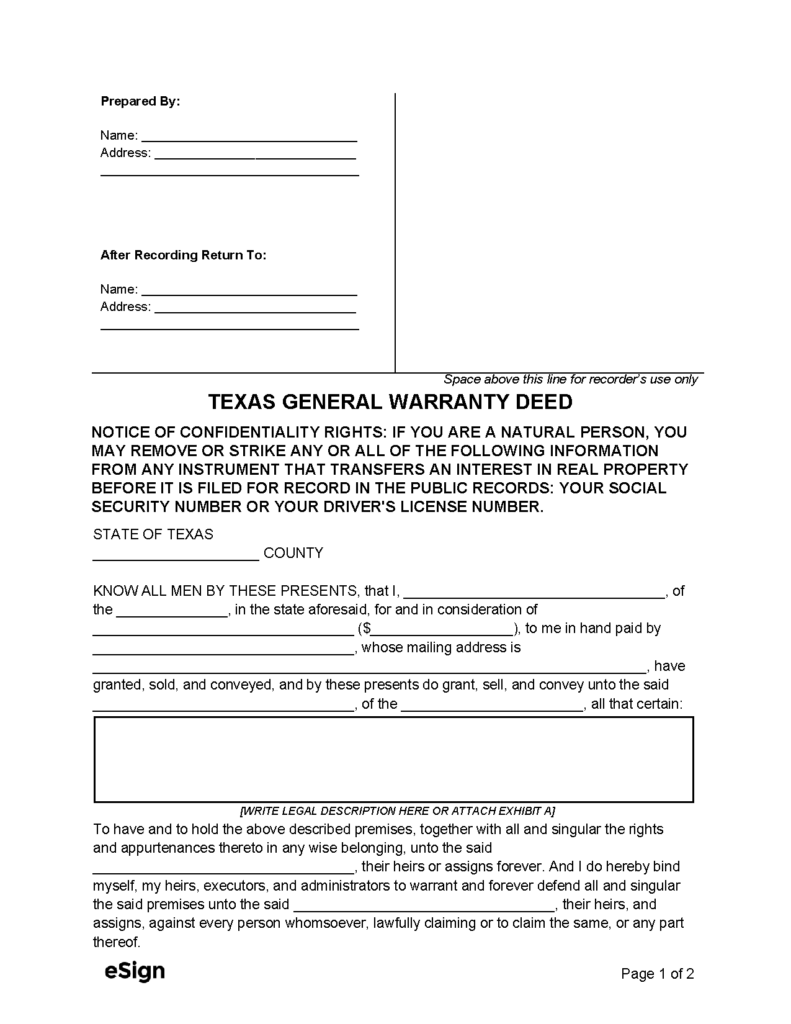

Quitclaim Deed vs. Warranty Deed

The primary difference between a quitclaim deed and a warranty deed is protection. With a quitclaim deed, the buyer has no guarantee that the seller has full ownership of the property or that the title deed is lien-free. This means the buyer could face a legal battle in the future if someone else has a legal claim to the property, known as a title defect, forcing them to hire a real estate attorney.

A warranty deed is used for most traditional home sales. It guarantees that the buyer is receiving full rights to the property and that no other party can make a legal claim to it once the transaction is completed. A warranty deed protects both parties in the event of a breach of contract. Although each deed is a type of legal document, the warranty deed provides far more protection for both the seller and the buyer.

Pros and Cons of Quitclaim Deeds

A quitclaim deed could be the solution you need as a property owner as you look to transfer your house to other family members or sell it quickly to interested buyers. There are several pros and cons to quitclaim deeds, which are important to understand whether you are the grantor (seller) or the grantee (buyer).

Pros of Quitclaim Deeds

Using a quitclaim deed makes transferring property much simpler. It is very straightforward since you simply have to fill out the paperwork, get it notarized, and then file it with the appropriate municipality. It is by far the best way to shift a property title to other family members or an estate.

Additionally, if you want to transfer ownership of your home to a family member after your death, you can use a quitclaim deed. A quitclaim deed can transfer property into an estate or living trust to avoid probate.

Cons of Quitclaim Deeds

The cons of a quitclaim deed mostly apply to buyers, but sellers can also experience some negatives. First, quitclaim deeds are typically used in non-sale scenarios, so the seller may not reap the benefits of equity in the home with a traditional sale. Even if there is money involved, it is usually much less than the home would be worth with a general warranty deed.

For the buyer, the disadvantage is not knowing if the grantor has full ownership rights of the property. You could find yourself in a dispute over ownership unless you pay for a title search.

When Should I Use a Quitclaim Deed?

Quitclaim deeds are not for everyone. There is a reason why warranty deeds are the most common way to transfer a real estate property from the seller to the buyer. Since there are risks involved and less protection for both the grantor and the grantee, this method should only be used in specific circumstances. Here are a few situations where quitclaim deeds can help.

- Adding a spouse to the title deed after getting married

- Transferring a property from one divorcee to the other

- Moving the property to a living trust or estate to use the loophole and avoid probate

- Attempting to sell your home quickly for a lower price to interested buyers

How to Overturn a Quitclaim Deed

There are various reasons why you might choose to overturn or nullify a quitclaim deed on your real estate property. Maybe you planned to give your property to a family member but they eventually found a better home to buy after initially agreeing to take over your property.

Fortunately, the process is relatively simple if both parties are on the same page. However, if you want to challenge a quitclaim deed and the other party disagrees, you should hire a real estate attorney to evaluate the validity of the deed.

It is very difficult to overturn quitclaim deeds once they are signed by both parties. You would need to prove that the other party used undue influence to get the document signed or that one of the parties was incompetent when they signed.

Summary

Transferring a property title from one party to another is a complex process. Warranty deeds are the way to go if you want all the legal protections of a typical home sale. However, a quitclaim deed makes the most sense if you are happy with a faster process and have a buyer who trusts you (typically close family members or friends). With this simple legal document, you can sign over your interest in the property to the other party without having to wait months for the closing date.

If you plan to use a quitclaim deed, research the process and talk to an attorney. Buyers who plan to acquire a home with this method must pay for a title search to ensure that no other parties can legally claim the property in the future.

Zach Shelley

Zach Shelley is a seasoned real estate investor with a diverse network spanning across the nation. As the founder of his own real estate venture, Zach is committed to offering innovative solutions to homeowners facing various real estate challenges.. Through his dedication and strategic approach, Zach continues to make a significant impact in the real estate industry, providing homeowners with alternative pathways to navigate their property transactions.